How to take advantage of the 1 July super cap increase

From 1 July 2024, the amount you can contribute to super will increase. We show you how to take advantage of the change. The amount you can contribute to superannuation will increase on 1 July 2024 from $27,500 to $30,000 for concessional super contributions and from $110,000 to $120,000 for non-concessional contributions. The contribution caps […]

Can my SMSF invest in property development?

Australians love property and the lure of a 15% preferential tax rate on income during the accumulation phase, and potentially no tax during retirement, is a strong incentive for many SMSF trustees to dream of large returns from property development. We look at the pros, cons, and problems that often occur. An SMSF can invest […]

Legislating the ‘objective’ of Super

The proposed objective of superannuation released in recently released draft legislation is: ‘to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way.’ The significance of legislating the objective of super is that any future legislated changes to the superannuation system must be in line with this […]

The shape of Australia’s future

We look at the key takeaways from the Intergenerational Report. The 2023 Intergenerational Report (IGR) is a crystal ball insight into what we can expect Australian society to look like in 40 years and the needs of the community as we grow and evolve. It doesn’t map out our path to flying cars and Jetsons […]

Super Savings & Strategies

Tax deductions for topping up Super You can make up to $27,500 in concessional contributions each year assuming your super balance has not reached its limit. If the contributions made by your employer or under a salary sacrifice agreement have not reached this $27,500 limit, you can make a personal contribution and claim a tax […]

Tax on Super Balances above $3M

In a very quick turnaround from announcement to draft legislation, Treasury has released the exposure draft legislation for consultation to enact the Government’s intention to impose a 30% tax on future superannuation fund earnings where the member’s total superannuation balance is above $3m. The draft legislation confirms the Government’s intention to: Currently, all fund income […]

The ‘Super’ Wars

A consultation paper released by Treasury has sparked a national debate about the role, purpose and access to superannuation ahead of the 2023-24 Federal Budget. What is the purpose of superannuation? At first glance, the consultation released by Treasury in February titled Legislating the objective of Superannuation sounds innocuous enough. The consultation seeks to anchor […]

Super Balance increase but no Change for Contributions

The general transfer balance cap (TBC) – the amount of money you can potentially hold in a tax-free retirement account, will increase by $200,000 on 1 July 2023 to $1.9 million. The TBC is indexed to the consumer price index each December. The TBC applies individually. If your transfer balance account reached $1.7m or more […]

Is ‘downsizing’ worth it?

Downsizer contributions are an excellent way to get money into superannuation quickly. And now that the age limit has reduced to 55 from 60, more people have an opportunity to use this strategy if it suits their needs. What is a ‘downsizer’ contribution? If you are aged 55 years or older, you can contribute $300,000 […]

Tax and the Normalisation of Cryptocurrency

In early November, the Commonwealth Bank announced that it is now Australia’s first bank to offer customers the ability to buy, sell and hold crypto assets, directly through the CommBank app. You know when the banks come on board, cryptocurrency has become normal. But cryptocurrency is only one part of the blockchain universe. Non-fungible tokens […]

Making Success Stick: How Laticrete Lifted Sales and Doubled Profits

Imagine seeing your business continue to grow, despite the pandemic. That’s exactly what Australian building materials manufacturer Laticrete has achieved—with the help of strategic planning from SRJ Walker Wayland. General Manager Emma Tschannen steers Australian operations for Laticrete Australia—with a strong annual turnover. After working with SRJ since October 2018, Emma describes a very high growth in […]

Recipe For Success: How Periwinkle Restaurant Beat the Pandemic

Business can demand everything—especially in hospitality. When French chef Frank Boulay and his wife Karin set up Periwinkle family restaurant on the Sunshine Coast, they needed accounting support that gave the business everything it deserved. Frank had helped open the Ritz-Carlton at Grand Cayman Island in the Caribbean—and been Executive Chef at the Sheraton in […]

Cosmetic Gold: How Digispectro is redefining ‘skin deep’.

Barry Amor and his company, Digispectro, are imagining better for the world with their award-winning invention—CompleXion. The handheld device perfectly captures the colour of a person’s skin, in all lighting conditions—a notoriously difficult challenge. This enables cosmetic manufacturers to create unique formulas with perfect colour matching. “But it goes beyond that,” Barry explains. “We can […]

Strength To Strength: How GDG learnt to love their annual audit.

Imagine a large non-profit with complex reporting looking forward to its annual audit. That’s exactly what happened for Brenda Pearson, Administrator of Global Development Group. “We build better lives for the world’s poorest people,” she explains. “As a charity, we have more than 5-million beneficiaries across the world, 15-thousand donors—and no government funding,” she says. […]

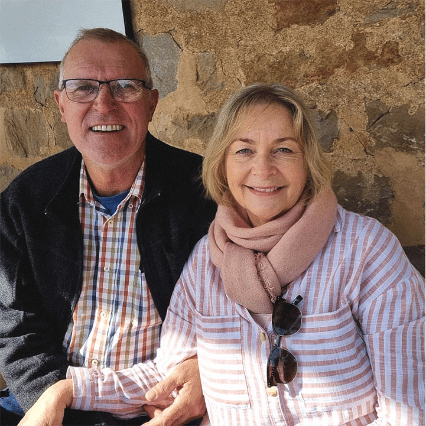

Secret Sale

“A year ago I was under great stress—John and the SRJ team carried us through a process—now we’re happily enjoying our retirement”. Andrew McDonaldDWC Tiles The Challenge—Selling Without Advertising Andrew and Lisa McDonald had worked hard making DW Custer Pty Ltd (trading as DWC Tiles) a thriving enterprise. But with no family succession possible, they […]